Tokenized Securities vs Security Token

By Jeff Gearhart, Ed Wegener and Buddy Doyle

Subscribe to our original industry insights

In previous episodes of our podcast series Cryptocurrencies and Digital Assets: The Wheels are Turning – Are You Up-to-Date? we’ve talked about cryptocurrencies and Stable coins, which of course are built on blockchain or distributed ledger technology. In this episode, Oyster’s Jeff Gearhart, Ed Wegener and Buddy Doyle discuss the nuances for determining if a digital token, whether it is a tokenized security or a security token, is in fact a security.

Transcript

Transcript provided by Temi transcript services

Oyster: Welcome to the Oyster Stew podcast, where we discuss what’s happening in the industry based on what we see as we work with regulators and clients. Oyster consultants are industry practitioners; we aren’t career consultants. We’ve done your job and we know the issues you face. You can learn more about Oyster Consulting and the value we can add to your firm by going to our website, oysterllc.com.

Hi, and welcome to part four of our podcast series on Cryptocurrencies and Digital Assets – The Wheels are Turning. Are You Up to Date? We’ve talked about cryptocurrencies and stable coins, which of course are built on blockchain or distributed ledger technology. In this episode, Oyster’s Jeff Gearhart, Ed Wegener, and Buddy Doyle discuss the nuances for determining if a digital token is in fact a security. If you like what you hear today, follow us on whatever podcast platform you listen to. Let’s join in.

Jeff Gearhart: In prior podcasts, the last one we talked about cryptocurrencies, which is one type of digital asset, but clearly not a security. I think it’s been defined as a commodity and falls under those rules, but are we in agreement that it’s a digital asset? I mean, it’s a pretty broad description, but it’s really digital, everything’s digital nowadays, but it has to be uniquely identifiable and have some sense of value to it. And does that?

Ed Wegener: Yeah, that’s the broad umbrella term that I’ve heard used to cover everything under that umbrella.

Jeff Gearhart: Okay. For my purposes today, I think we should talk about digital tokens and there are multiple types. And I think the big question is whether an audit is a security or not, we’ve done other podcasts. And I know you’ve spoken to this and I’ve heard you mentioned at the Howey test. Should we just cover, you know, what the four criteria are pretty quickly just to, to frame in the digital tokens as we have this discussion. I think that would be great. Ed, do you want to lead the charge on that?

Ed Wegener: Yeah, I think that having this definitional discussion is a good one because I think people hear a lot of different terms that are thrown around and to really understand the nuances and the differences are important because depending on what term you’re using, it could have different requirements and it could mean a different thing. And when he talks about a digital token, it could be a security token and then defining what that means that you’ve got a utility token in which would be different versus what a cryptocurrency is and all of those things. And they kind of get lumped in together. People use them interchangeably, which when you’re talking abstractly probably isn’t a problem. But when you’re talking about specific requirements that fall out from how they’re defined, you know, it’s important, those distinctions are important

Jeff Gearhart: When you’re making that determination though, the Howey test gives you the guidelines for making the decision that

Ed Wegener: Even for the discussion about whether it’s a security or not definitely. And it’s the traditional investment contract definition that the sec uses based on that the WJ Howey test and the sec did put out a guidance document that they call the framework and it was issued with a no action letter in the no action letter. The conclusion that they drew was that the token that the entity was asking about was determined to not be a security, but to be a utility token, they were tokens that people could use to get time on these private jets and, you know, because the tokens were used for that purpose when they didn’t meet the definition of a security, the sec said based on our analysis of the hallway test, these aren’t securities, and then what they ended up doing is providing this framework for that being said, here are the things you need to consider when determining whether it should be a security and it’s the same criteria.

You know, it’s an investment of money in a common enterprise with the expectation of profits from the efforts of others. But that’s easy to say, but when you take a digital token, how do you go about piecing that apart and saying in a digital token sense, what does it mean to rely on the efforts of others? You know, and the STC in that guidance document, talk about the kind of things that you need to look at. One of which is if the value of the token bears no resemblance to the actual value of the utility that you would get, it’s more than likely probably a security. So if the token is meant to buy you an interest on a jet, which might cost a few thousand dollars where as the value of that token is trading at $20,000, then there’s really no that the value of the token doesn’t bear a resemblance to the value of the utility. And we might say that that you’re really speculating and you’re investing with the expectation that you might profit from it.

Jeff Gearhart: I think an analogy that worked for me on these utility tokens is that the casino chips, it only works in the casino. It doesn’t give you ownership of the casino. You can’t spend it at the store down the street. It’s a good representation. I think of a utility token versus a currency or a security. I think that that makes a lot of sense to look at it that way it’s important

Buddy Doyle: That people keep in mind that just because you’re getting the casino chips like ed was talking about, there is still the possibility that you have a security as well. So if you’re buying the token and it’s a utility token that comes with casino chips, but you’re actually funding the building of the casino and participating in the profits and losses of the casino, the chips are just a benefit, but it is still a security. Uh, and you will keep all those chips until you go back to the house.

Jeff Gearhart: All right, well that just emphasizes, then it’s important to get the decision, right? I just read, um, actually today, I think it was in the wall street journal yesterday that Gensler has come out again and said that even though people were trying to use decentralized finance to avoid having things classified as securities likely they are, and the sec is paying attention. And there’s been numerous examples where they find people were closed people down for, in gauging insecurities activities, even though they may have thought they were not so important questions.

Buddy Doyle: Yeah. There are a lot of Val shalt knots in regulation right now about these digital assets. Still trying to find the clear path to success there for a lot of, uh, a lot of firms.

Ed Wegener: Well, and if you’re engaging in any sort of digital asset activity, one of the first questions you should ask yourself is, is it a security? And you should do that analysis or have an attorney do that analysis for you. Otherwise you’re taking a very big risk that you might be engaging in activity that requires registration. And that’s one of the questions that the exchanges are asking themselves right now is I’ve got all these tokens that are trading on my venue. And if any, one of those tokens would be deemed to be a security, my exchange may need to be registered as a registered exchange or as a broker dealer ATS.

Buddy Doyle: Yeah. And I think all of that stuff, right? All these unregistered exchanges out there that who knows what they really had a underlying what’s being traded on their platform. You know, there’s, there’s a lot of risks there and that’s slowing down the, uh, the ability to move forward because the current infrastructure, you know, I think the sec wants to be confident that they’re creating a trusted marketplace where the rules are known and that, you know, what fair and is, and, and what’s expected. So while these unregistered, uh, exchanges have things that we don’t know about, I mean, they got to clean themselves up or at least do a review and prove that they’re clean, I guess, to get through that process.

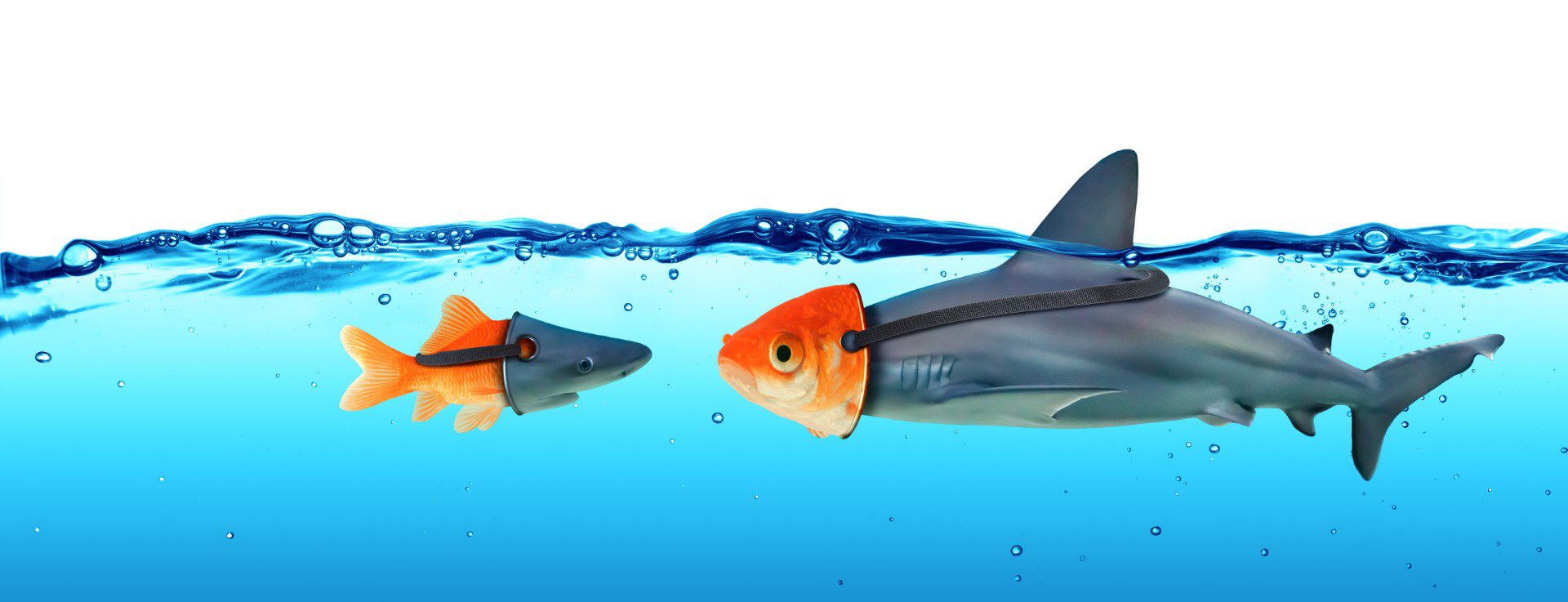

Jeff Gearhart: I think that’s going to be one of the keys for broader acceptance and institutional acceptance to the security or the confidence in the platforms. I do want to bring up a concept, tokenized security versus security token. And we’ll probably talk more about security tokens, but tokenized securities, from my perspective, that’s simply an existing security that we all know that’s been put into a token form almost as a derivative. No doubt that that’s a security, correct?

Ed Wegener: No, I want you to say, yeah. I mean the underlying, the underlying asset that it’s attaching to is a security and therefore the trading of it would be treated just like a security. So yeah, I would think that it, it is, you know, in those cases, the, the, the token really is just there to represent the security and to aid in the ease of transfer and to, um, be able to, um, identify ownership. And I see a big value in that because it could, you know, we’ve talked about this before. It could aid in the clearing and settlement and the speed at which you can clear and settle securities transactions. So those digital representation of real securities, I think really have a lot of benefit, but they would be considered to be securities.

Buddy Doyle: We had them a lot, like I do an ADR, right. It is representative of the ownership, but it is different is its own unique thing. And I consider them to be securities just as ATRs are securities when they’re trading here in America.

Jeff Gearhart: Okay. So really they just broaden the market and enhance liquidity. It’s just another distribution channel. Yes. So the fun topics, security, tokens, um, that’s where the Howey test comes in, right. Uh, it’s a token versus a security and it’s, it can be at attached to an asset. So this is really from my perspective where the game changes, um, in terms of what can be securitized, can anything be securitized, artwork, ownership, and different things. I mean, we might be sliding a little bit into non fungible tokens, real estate. I mean, the answer is yes. Right.

Ed Wegener: But potentially, I mean, if you think of that, the token is a representation of your ownership interest in an aids in identifying who owns either a particular underlying asset or a share in that underlying asset. And it also is used to, um, facilitate and identify and validate transfer of ownership from one person to another. Yeah. You can attach any underlying asset to that with a, a token that represents that ownership or that piece of ownership in that asset.

Jeff Gearhart: It can represent ownership in that asset. And then I write to the profitability of the asset, correct. This could be the Bose changing impact to the market. Tokens are a new product where tokenized security is just an existing security. We’re all familiar with. So it really expand assets that are traded and traded on exchanges and things of that nature.

Oyster: Thanks for listening. And if you like what you heard, make sure to follow the Oyster Stew podcast on whatever platform you listen to. If you’d like to learn how we can help firms start, run, protect, and grow their business, visit our website@oysterllc.com.