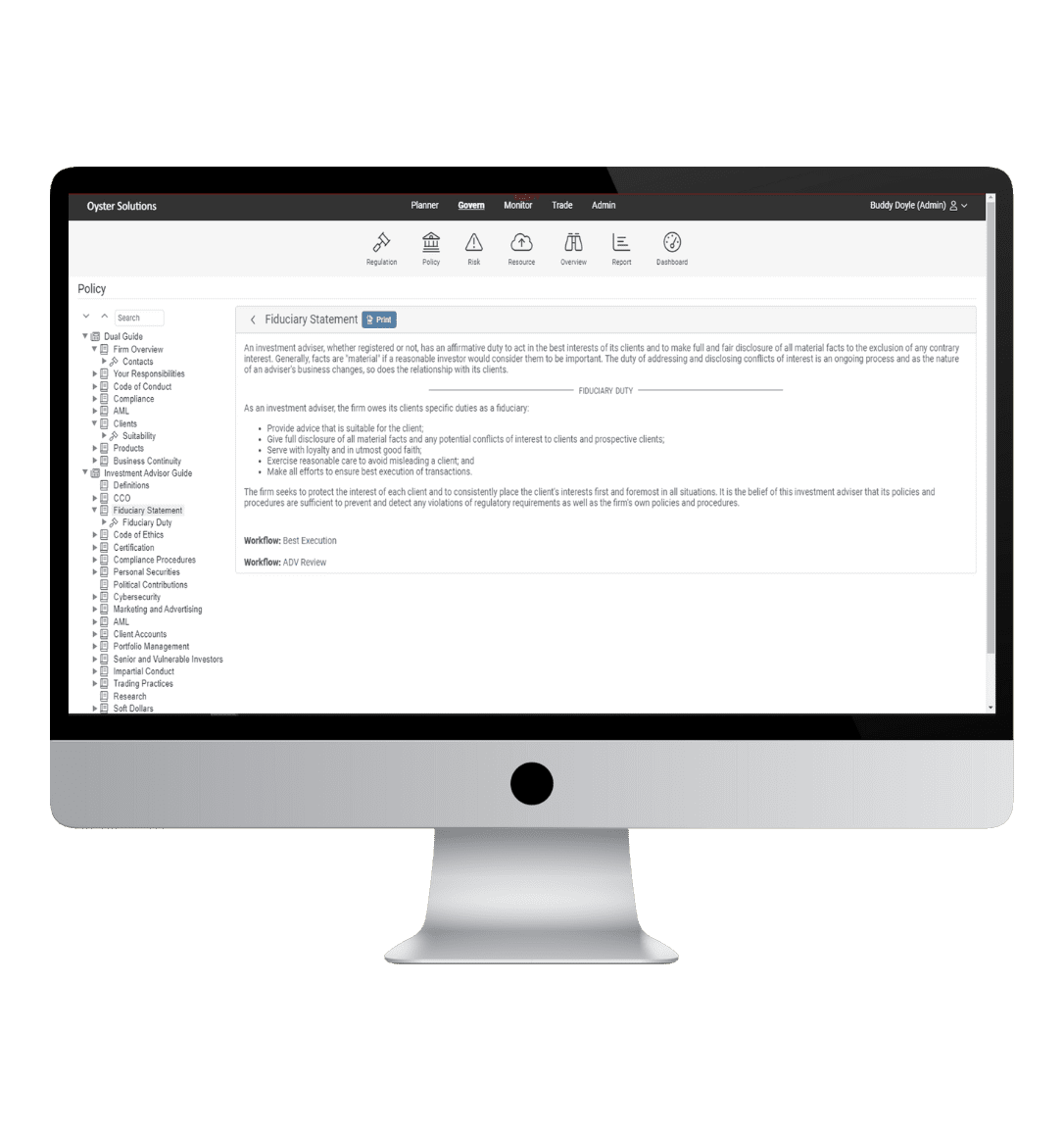

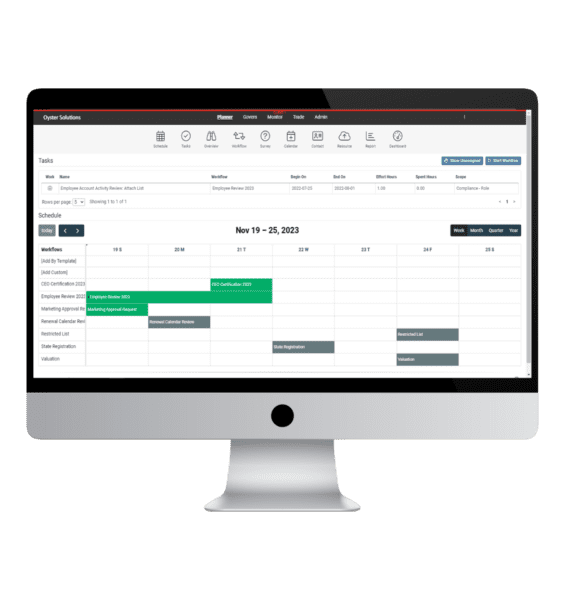

GRC Governance Simplified

The Oyster Solutions platform was created to help firms like yours operationalize the requirements of your governance, risk and compliance programs. GRC tools allow firms to manage and integrate policies, assess risk, enforce procedures, control user access and streamline processes. This module helps you define and quantify your risk, matching risk to your controls and monitoring process. Oyster Solutions keeps your business and controls balanced while meeting your regulatory requirements.

Talk To Our Experts