Consolidated Audit Trail: Moving on to Phase 2c

By Ralph Magee

Subscribe to our original industry insights

Now, more than ever before, firms need to prepare for the increase in CAT Reporting complexity and make sure they are well-positioned to surveil CAT reporting.

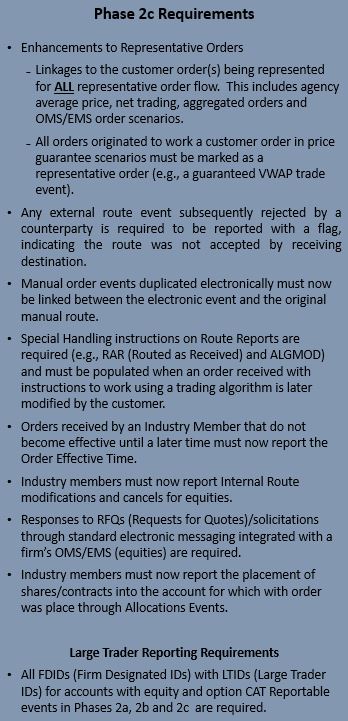

On January 4, 2021, the last implementation of Option linkage compliance came into effect, and the industry completed the 2a and 2b phased implementation of CAT (Consolidated Audit Trail). The industry now shifts its focus to Phase 2c and Large Trader Reporting. Each of these upcoming implementations will be required on April 26, 2021, and both increase the complexity of the data reported to CAT.

The Phase 2c test environment opens on January 26, 2021.

FINRA CAT will open a new Prod-Mirror environment for Industry Member testing of Phase 2a/2b code. Industry Members should also be aware of additional details outlined by FINRA CAT in their most recent Phase 2c cutover webinar, held on January 19, 2021. This recording can be found here.

The introduction of Allocation events will require additional reporting detail and increases the overall events submitted to CAT. Remember, the reporting obligation for these events belongs to the firm performing the allocations. Generally, this will be the clearing firm or the self-clearing firm. These events are separate and distinct from the obligation to report new order events.

For more information call (804) 965-5400 or click here. Oyster Consulting can help you manage your requirements assessment and implementation phases, interface with your own technology providers, assist in testing data scenarios and data linkage, as well as create an error repair process.

Leverage Oyster’s CAT Application to gather and analyze reported data and errors. Efficient data analysis and repair saves time while reducing risk, allowing you to focus on other things. Our industry experts work one-on-one with our clients as they use the platform, helping with rejections and corrections.