How to Choose the Right Clearing and Custodian Partners

Subscribe to our original industry insights

For any new financial firm setup, choosing the right clearing firm or custodian is one of the most consequential early-stage decisions you’ll make. These relationships are central to your business operations, impacting everything from trade settlement and client onboarding to compliance, reporting, and your overall risk framework.

For startup RIAs and broker-dealers, custodian selection or clearing firm partnerships can either become a friction point or a competitive advantage. That’s why firms must approach this process strategically, with a clear understanding of how each partner will fit into their larger business planning.

At Oyster Consulting, we guide firms across the United States through vendor evaluation and onboarding as part of their new firm planning. This article outlines what you need to know to select partners that support your growth and help you mitigate risks along the way.

Understand the Role of Clearing and Custodian Partners

Though they’re often mentioned together, clearing firms and custodians serve distinct roles depending on your firm structure.

- Clearing firms, primarily used by broker-dealers, handle the execution, confirmation, settlement, and custody of securities transactions. They also assist in recordkeeping and maintaining internal controls for regulatory reporting.

- Custodians, often used by RIAs, safeguard client assets, process account-level transactions, and provide data for performance and billing tools. Good custodians support your financial planning processes and help deliver a seamless client experience.

Regardless of your registration type, these partners play a foundational role in your firm’s business processes, regulatory posture, and ability to scale.

Evaluate Alignment with Your Business Model

Not all custodians or clearing firms are built for startups. Some prioritize large institutions, while others offer white-glove onboarding and integration support tailored to smaller, emerging firms.

Before signing an agreement, consider:

- Will this partner integrate with your core systems (CRM, portfolio tools, compliance)?

- Can they accommodate your service model—hybrid advisory, fee-only, or transactional?

- Do they support the product types you plan to offer now and in the long term?

Your clearing or custodian selection should align with your growth strategy—not just your day-one structure. A mismatch here can introduce delays, operational risk, and even client attrition.

Incorporate Risk and Compliance into the Selection Process

Selecting a custodian or clearing firm isn’t just a technology or service decision—it’s a key part of your firm’s risk framework. Regulators expect firms to conduct vendor risk assessments, perform ongoing due diligence, and establish clear responsibilities in their policies and procedures.

Choosing the wrong vendor could expose you to:

- Regulatory risk from data breaches or reporting failures

- Operational risk caused by downtime, integration failures, or human error

- Disruptions to your business operations or financial statements

Oyster helps firms conduct structured due diligence that includes evaluating cybersecurity protocols, escalation procedures, business continuity planning, and service-level agreements.

Think Beyond Day One

It’s easy to focus only on onboarding timelines or immediate features—but smart business planning requires looking ahead. As your client base grows and your operational needs become more complex, your vendor relationships need to evolve with you.

Ask:

- Can this partner support your needs as trading volume increases?

- Will they be responsive as compliance expectations evolve?

- Do they offer reporting features that support both clients and regulators?

Your ability to mitigate risks over time will depend, in part, on how flexible and responsive your clearing or custody partner is. With proper due diligence and continuous monitoring, this relationship can enhance your compliance program and strengthen your bottom line.

Consider the Full Ecosystem

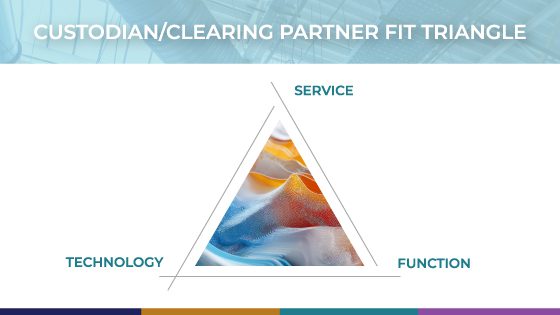

Your custodian or clearing partner doesn’t operate in a vacuum. They’re part of your firm’s broader supply chain of technology, people, and processes.

During your evaluation, look for partners that:

- Support automation and data flow across systems

- Integrate with your compliance tech and financial services platforms

- Provide transparent service metrics and escalation points

- Help reinforce your business practices, not add friction

The goal is to reduce risk while increasing control. A strong partner should help your team operate more efficiently and with fewer manual touchpoints.

Final Thoughts and Key Takeaways

Choosing the right clearing firm or custodian isn’t just a vendor decision—it’s a foundational move that will shape your firm’s financial services delivery, compliance program, and ability to scale.

Here are your key takeaways:

- Start with a clear understanding of your business model and growth plan

- Evaluate vendors not just on features, but on risk management, scalability, and regulatory fit

- Conduct structured due diligence and maintain continuous monitoring after onboarding

- Prioritize integration, service, and long-term partnership potential

- Document the risk assessment process and ensure it’s reflected in your policies

Want to learn more about smart vendor selection and oversight? Explore our guide to vendor risk management [link to opt-in page].

Need help choosing the right clearing or custody partner? Contact Oyster Consulting for help evaluating your options and building a stronger foundation for your firm.

Learn about our process at Oyster and how we support new firms through registration, infrastructure design, and risk management with hands-on, experienced consulting.