CAT Update – SEC Issues Anticipated Extended Exemptive Relief

By Ralph Magee

Subscribe to our original industry insights

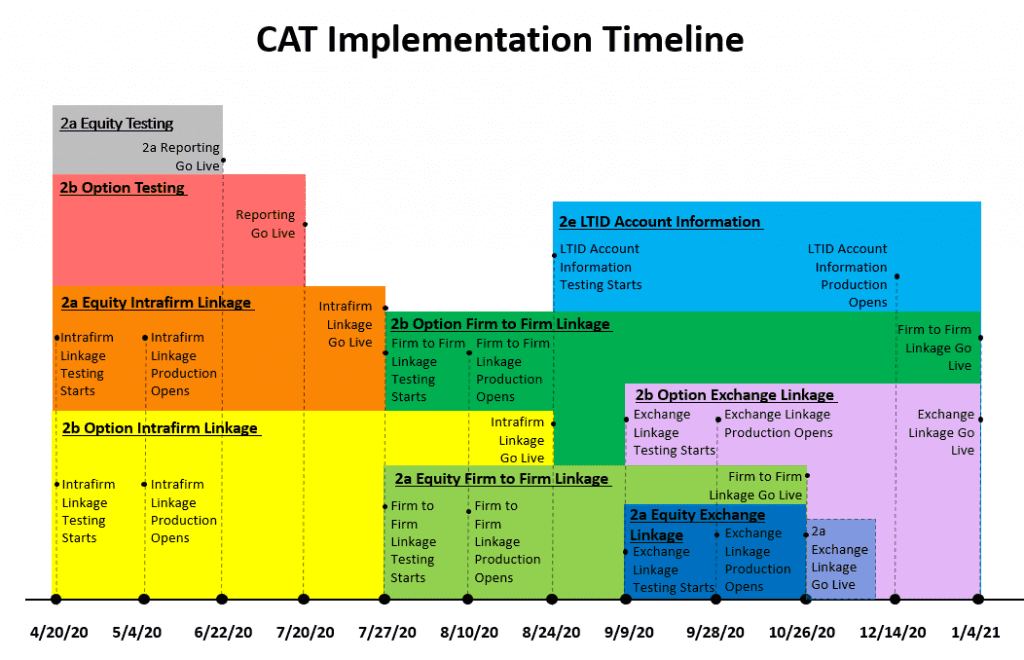

Just a few weeks ago we announced the SEC’s provision of exemptive relief, which allowed Industry Members to delay their CAT reporting until May 20th. At that time, CAT participants had also formally requested additional relief. Well, they got their wish. The SEC has now provided the relief, which is more in line with the original phased implementation approach. Instead of a compliance date of May 20th, Industry Members now have exemptive relief for Phase 2a (Equity securities) until June 22nd, 2020 and until July 20th, 2020 for Phase 2b (Option securities).

It is important to note that Industry Members who have completed the onboarding and certification can begin reporting to the production environment of FINRA CAT. In fact, we are happy to report that all of the clients we are currently working with have commenced CAT reporting.

It is our recommendation that firms should not expect further delays and should prepare a robust CAT reporting project plan for the coming months. Although firms now have additional time they can use for phases 2a and 2b, there were no changes to the additional regulatory timeline for future. This compresses the amount of time available for Industry Members to become compliant for the upcoming Linkage requirements, as well as Phase 2c, 2d, 2e and LTID requirements. Many of these workstreams will overlap between now and the end of the year, and even into 2022:

Firms need to be prepared. The CAT is here to stay and will eventually replace several other required systems including OATS, Electronic Blue Sheets, LTID reporting, and may also expand into additional security asset classes. Oyster Consulting can help you assess how your firm is positioned for CAT readiness, manage your requirements assessment and implementation phases, interface with your own technology providers, and assist you in determining what and how your technology providers will report for you. We can also assist in testing data scenarios and data linkage, as well as creating an error repair process. Firms can also leverage the Oyster CAT Application to gather and analyze reported data and errors. You can schedule a demo and one of our associates will be happy to assist you.

You can also listen to our podcasts and read our blogs to learn more about the new deadlines and what your firm should be doing to prepare.