Compliance Management Software: Oyster Solutions

Watch Our On-demand Demo

Financial Services Compliance Software Designed By Industry Experts

Modernize Your Compliance Efforts

Every day your Compliance team’s job gets harder. New compliance requirements and expanding technology capabilities are forcing your firm to move faster to stay compliant. To protect your firm and your clients, your team needs modern regulatory compliance software. Regulatory compliance management software will do all of the following to reduce the burden of compliance management:

- Streamline your tasks

- Document your work

- Enforce controls

- Integrate your policies and procedures

Compliance Automation Software

Today’s industry demands an efficient and effective compliance program. Oyster Solutions’ powerful integration and automation features streamline compliance and provides:

- The surveillance tools your firm needs

- Accurate supervision and the reporting structure that regulators demand

- A streamlined, easy to follow experience for your employees

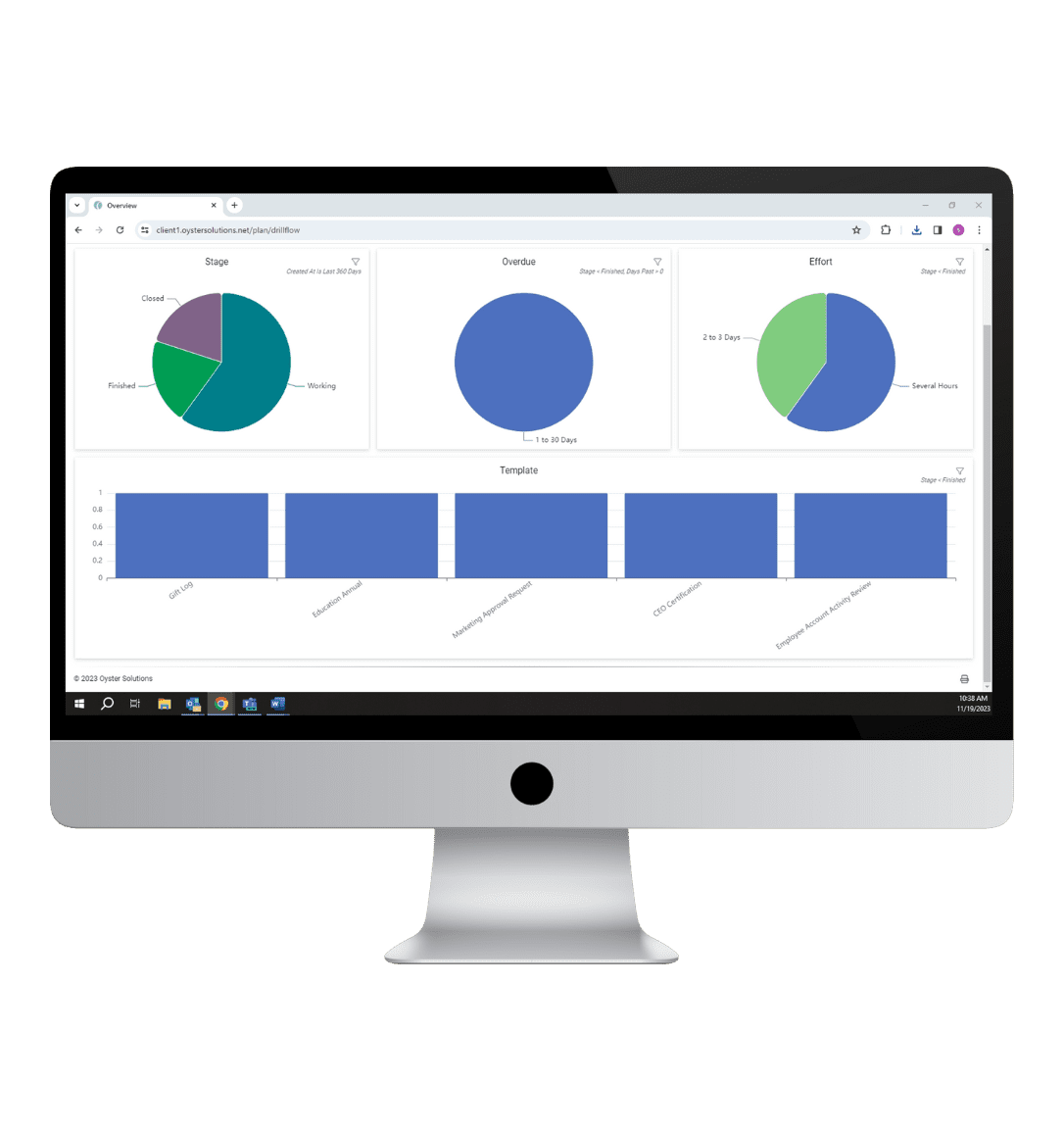

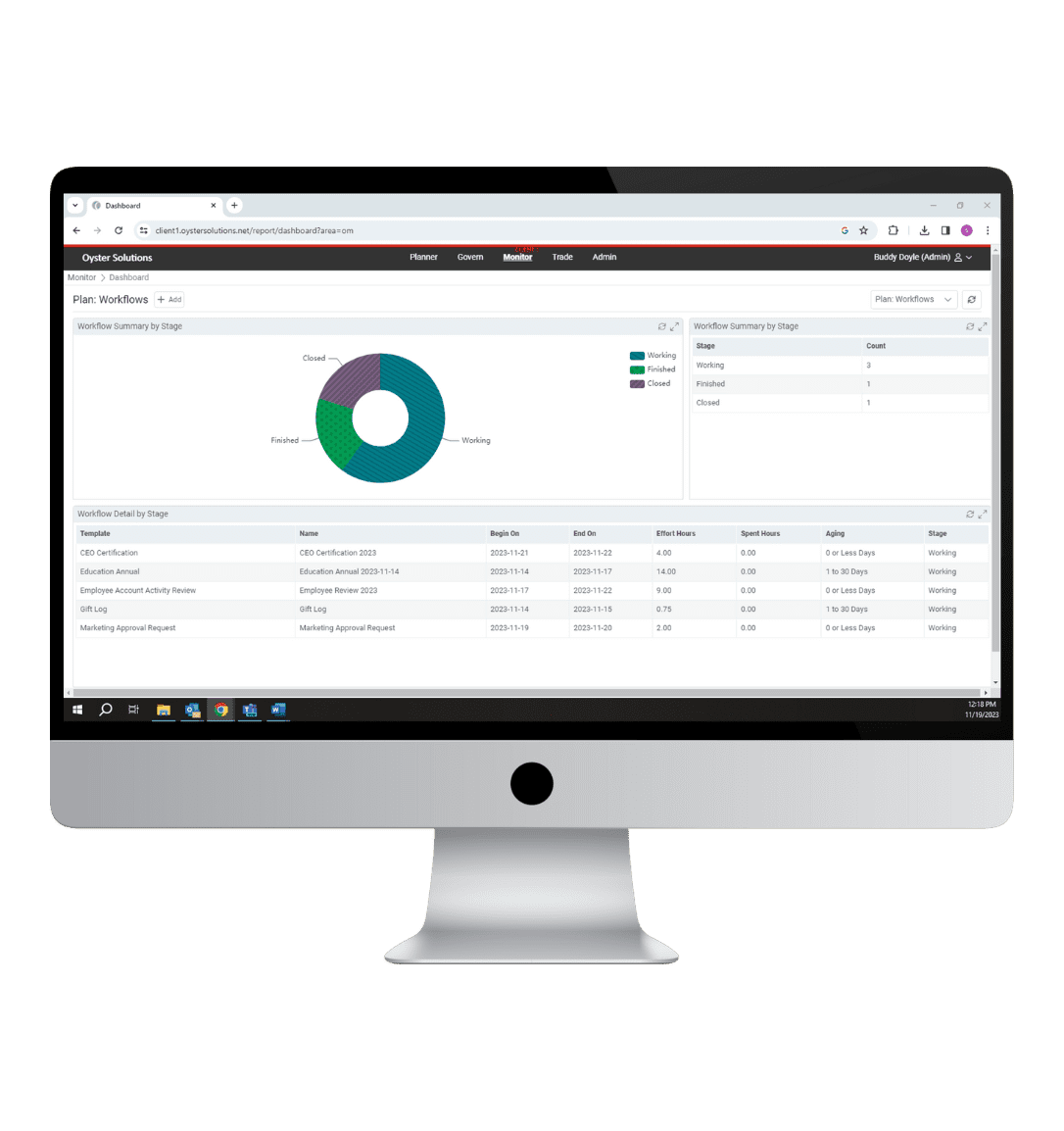

Compliance Reports and Dashboards

Easy-to-understand reports and dashboards let you focus on the information you need to prioritize your work and keep the team on track. Our comprehensive reporting software lets you know which workflows and tasks are on track. Risk reports are tailored to your firm’s lines of business, products and risk tolerance. Keep your projects organized and moving with Oyster Solutions.

Watch A Demo Now

How Oyster Solutions Raises Compliance Standards

- For Leadership

Access and surveillance are at your fingertips with our financial compliance software. You’ll be able to drill down to view a specific workflow, survey or user. Score, prioritize and integrate your firm’s risk tolerance. Our tailored risk assessments measure the performance of the control versus actual risk.

Maintain books and records compliance with documentation that is centralized. Trade exceptions are segmented and presented for supervision review, saving time and effort while reducing error. We integrate your policies with procedural workflows for efficient and seamless regulatory compliance.

- For Compliance Professionals

Automated reminders keep employees on track. Easy reporting tracks every step of compliance to ensure you and your team are efficient and well-informed.

Testing and documentation are scheduled and maintained in one system, eliminating multiple files and individual spreadsheets. Oyster Solutions allows you to easily track and collect attestations and certifications, with robust reporting for oversight and surveillance.

- For Users

Frictionless compliance for all employees. In our permissions-based platform, users are presented with the correct level of information and visibility.

Employees have a consolidated view of easy-to-understand tasks and a calendar to track progress. Easy policy review and entry of attestations, OBAs, business gifts, entertainment and political contributions help submissions move smoothly throughout the approval process. Additionally, exceptions are documented and tracked effortlessly. Automated workflow triggers reduce employee application frustration.

Explore Our Software

- Oyster Solutions Planner Our workflow scheduler and processing module. Start workflows, record tasks and work completed, document testing, and collect attestations and certifications. Reportable for oversight and surveillance.

- Oyster Solutions Govern This module houses policies, procedures, and risk assessments. Map these to regulatory requirements, products, lines of business, and supporting workflows, structuring consistent enforcement of procedures and controls. Reportable for oversight and surveillance.

- Oyster Solutions Monitor Our compliance monitoring software supervises and oversees client and employee activity. It compares client trading, investment holdings, and profile information with employee data to identify conflicts of interest and compliance issues. Supervisors are alerted to any activity that exceeds set parameters.

- Oyster Solutions Trade Reporting The CAT and CAIS functionality assist firms with SEC and FINRA trade reporting requirements. This module provides firms with consolidated reporting across order management systems and facilitates bulk updates and repairs to close out issues with source system reporting.

- Oyster Solutions Fund Analyzer This module assists firms in identifying the lowest cost share class options when purchasing mutual funds. The system utilizes MorningStar data to compare fees, account types, and returns of funds that meet the selection criteria.

Learn how Oyster Solutions creates a modern, effective compliance program that protects your firm and provides value.

Download