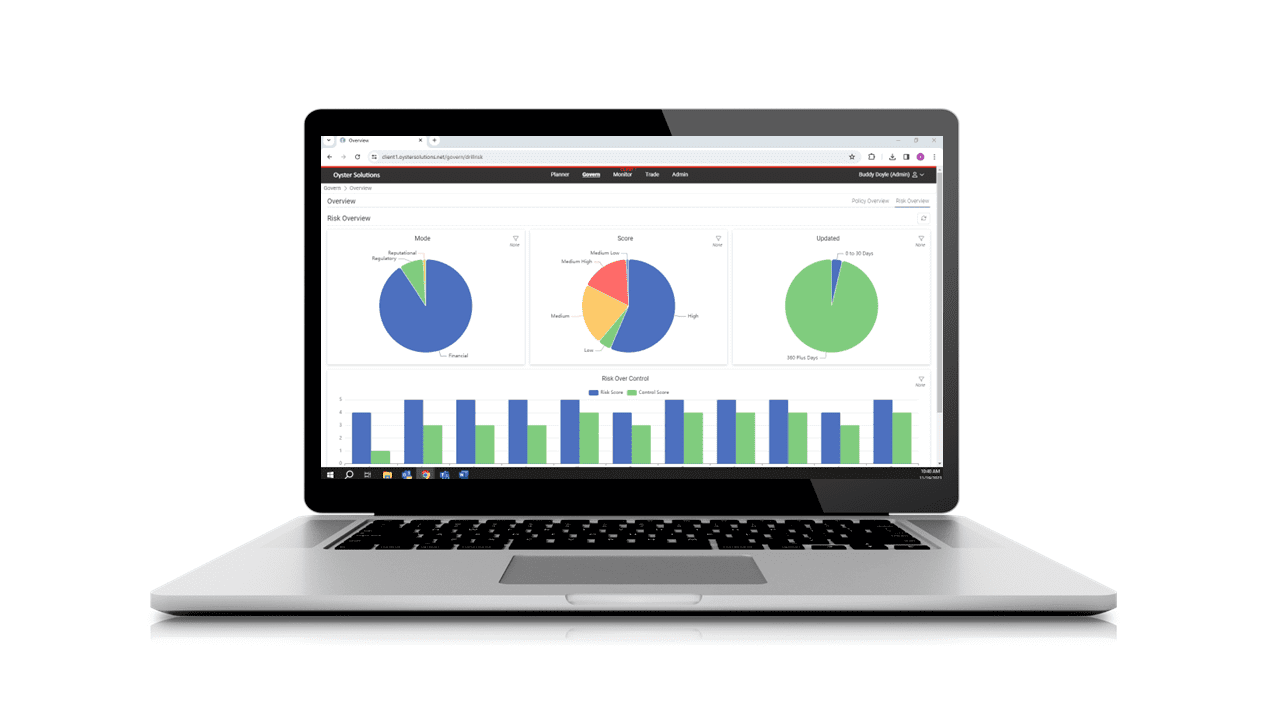

The Compliance Consulting You Need

As a Chief Compliance Officer, you need support managing risks. Keeping your compliance program up-to-date with evolving regulatory requirements is crucial for safeguarding your business. For dual-registered firms, we conduct Investment Advisor Annual Review mandated by SEC Rule 206(4)-7.

Consult With Our Experts